Behavioral origins of distinctions in employees’ attitude towards corruption

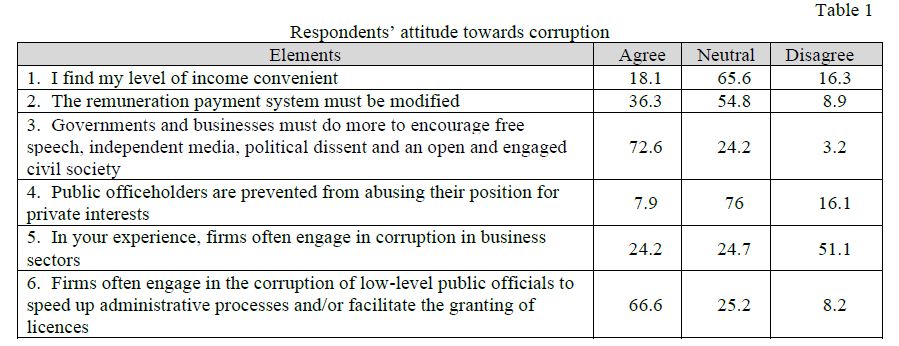

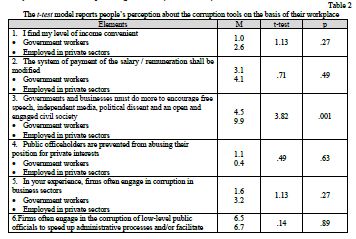

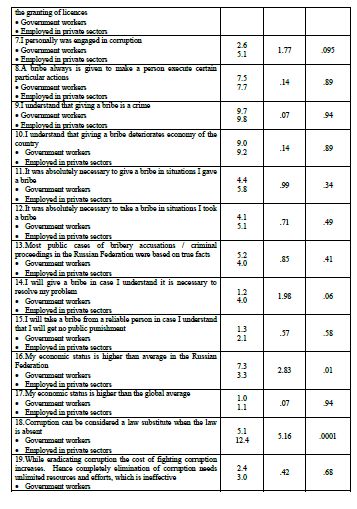

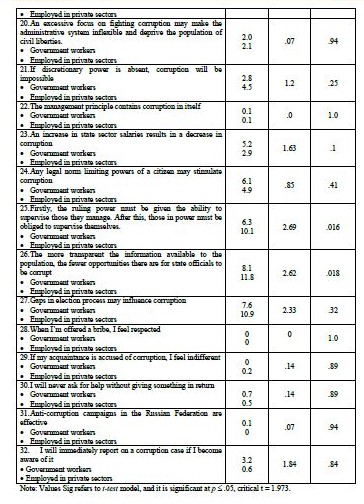

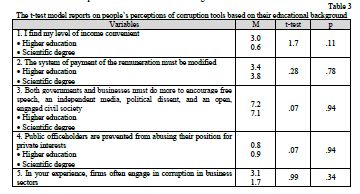

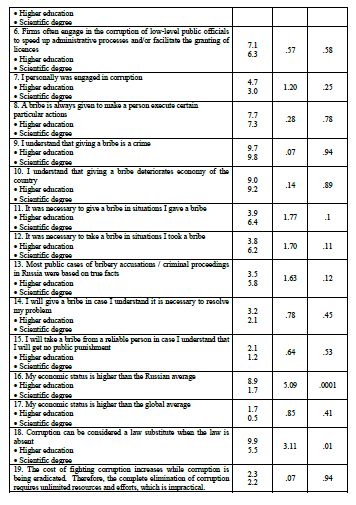

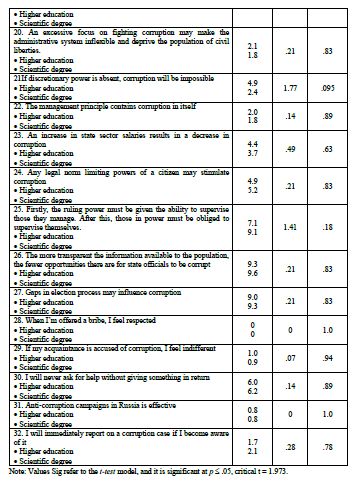

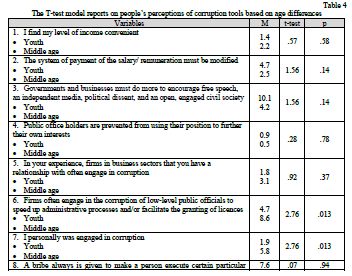

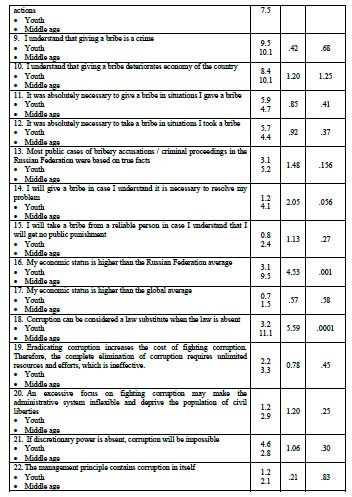

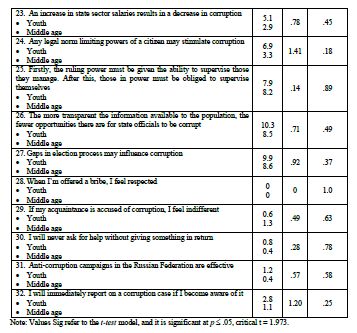

Purpose. The study examines the behavioral determinants that explain why successful and well-paid employees may become involved in corrupt practices. It aims to identify how attitudes toward corruption differ across age groups, education levels, occupations, and subjective economic status among employees working in the Russian Federation. Methods. The research is based on Descriptive Decision Theory as the conceptual foundation for explaining regularities in individuals’ choices. It employs a mixed-methods design, including semi-structured interviews, participant observation, and surveys, with a sample of 256 respondents employed in the Russian Federation (not all of Russian origin). The data were analyzed through thematic analysis as the primary ethnographic method. Given the size and heterogeneity of the Russian labor market, the sample used in this study requires additional clarification regarding its representativeness. The 256 respondents included in the research do not claim to statistically represent all employees in the Russian Federation; rather, they form a purposive sample focused on capturing behavioral patterns among economically active, legally compliant, and socially integrated workers – groups most relevant to analyzing the paradox of corruption among successful employees. Accordingly, the general population for the study is intentionally narrowed to employed individuals with stable income and established career trajectories, which allows for a more accurate examination of behavioral factors influencing attitudes toward corruption. This approach ensures conceptual, rather than statistical, representativeness by aligning the characteristics of the sample with the theoretical objectives of the research. Results. The findings reveal distinct patterns among several groups: youth and middle-aged employees, private-sector and government workers, individuals with higher education and those holding scientific degrees. Behavioral features associated with Prospect Theory – such as anchoring, loss aversion, and risk-seeking – serve as explanatory mechanisms for differences in corruption-related attitudes. This study addresses the central paradox that successful, socially integrated and well-paid employees – individuals who, according to classical economic and legal assumptions, have the least incentive to engage in corruption – are nonetheless vulnerable to corrupt behaviour. This challenges the traditional view that corruption is primarily driven by economic need or lack of resources. Instead, it suggests that behavioral factors, cognitive biases, and situational perceptions may outweigh rational cost-benefit calculations. It is essential to identify and explain this contradiction in order to understand why corruption persists, even among those who seemingly have the most to lose. Scientific significance. This study represents the first research of this type using Russian empirical data while integrating behavioral insights with national legal norms and regulatory practices. It provides an interdisciplinary perspective on how human behavior, convenience, facilitation, and productivity interact within corruption contexts. The results offer guidance for designing future regulatory measures aimed at reducing corruption levels.

Figures

Shashkova, A. V., Kudryashova, E. V., Verlaine, М. (2025), “Behavioral origins of distinctions in employees’ attitude towards corruption”, Research Result. Sociology and management, 11 (4), 170-189.

While nobody left any comments to this publication.

You can be first.

Armand, A., Coutts, A., Vicente, P. C., & Vilela, I. (2023), “Measuring corruption in the field using behavioral games”, Journal of Public Economics, 218, DOI: 10.1016/j.jpubeco.2022.104799.

Barberis, N. (2013), “Thirty Years of Prospect Theory in Economics: A Review and Assessment”, Journal of Economic Perspectives, 27 (1), 173-96, DOI 10.3386/w18621.

Bruhin, A., Fehr-Duda, H. & Epper, Th. (2010), “Risk and Rationality: Uncovering Heterogeneity in Probability Distortion”, Econometrica, 78, 1375-1412, DOI:10.2139/ssrn.1415975.

Cenerelli, A. (2019), “Administrative justice in Russia”, Diritto pubblico comparato ed europeo. Rivista trimestrale, (1), 101-136, DOI:10.17394/92977.

Dupuy, K. & Neset, S. (2018), The cognitive psychology of corruption: Micro-level explanations for unethical behavior, Working Paper Anti-Corruption Resource Center.

Gans Morse, J., Kalgin, A., Klimenko, A., Vorobyev, D., Yakovlev, A. (2021), “Self Selection into Public Service When Corruption is Widespread: The Anomalous Russian Case”, Comparative Political Studies, 54(6), 1086-1128, DOI: 10.1177/0010414020957669.

Goldman, M. (2005), “Political Graft: The Russian Way”, Current History, October,313-318, DOI: 10.1525/curh.2005.104.684.313.

Golesorkhi, S., Mersland, R., Randoy, T., & Shenkar, O. (2019), “The Performance Impact of Culture and Formal Institutional Differences in Cross-Border Alliances: The Case of the Microfinance Industry”, International Business Review, 28 (1), 104-118, DOI: 10.1016/j.ibusrev.2018.08.006.

Hesse-Biber, S. N. (2010), Mixed methods research: Merging theory with practice, New York, NY: Guilford Press.

Heywood, P. (2017), “Rethinking Corruption: Hocus-pocus, Locus and Focus”, Slavonic and East European review, 95 (1), 21-48, DOI:10.5699/slaveasteurorev2.95.1.0021.

Huang, W.-Y. (2018), “Influence of Transparency on Employees’ Ethical Judgments: A Case of Russia”, Journal of Business Ethics, 152 (4), 1177-1189, DOI:10.1007/s10551-016-3327-z.

Incio, J., Seifert, M. (2024), “How the Perception of Corruption Shapes the Willingness to Bribe: Evidence From An Online Experiment”, International Journal of Public Opinion Research, 36(3), DOI: 10.1093/ijpor/edae035.

Inozemtsev, M. I., Nektov, A. V. (2023), “Foreign Dissertations on Digital Law: Statistical and Literature Review”, Digital law Journal, (4), 1, DOI: https://doi.org/10.38044/2686-9136-2023-4-1-28-63.

Kasatkin, P. L., Kovalchuk, J. A., & Stepanov, I. M. (2019), “The modern universities role in the formation of the digital wave of Kondratiev’s long cycles”, Voprosy Ekonomiki, (12), 123-140, DOI: 10.32609/0042-8736-2019-12-123-140.

Kahneman, D. (2003), “Maps of bounded rationality: Psychology for Behavioral Economics”, American Economic Review, 93 (5), 1449-1475, DOI: 10.1257/000282803322655392.

Kasyanov, R., Kriger, A. (2020), “Towards Single Market in Financial Services: Highlights of the EU and the EAEU Financial Markets Regulation”, Russian Law Journal, 8(1), 111-137, DOI: 10.17589/2309-8678-2020-8-1-111-137.

Kobis, N. C., Bonnefon, J.-F., & Rahwan, I. (2021), “Bad machine corrupt good morals”, Nature Human Behaviour, 5 (6), 679-685, DOI:10.1038/s41562-021-01128-2.

Kuteleva, M.A., Ganevich, O.K., Romel, S.A. (2023), “Bribery as a Form of Corruption”, International Journal of Professional Science, (1), 5-10.

Muramatsu, R., Bianchi, A. (2021), “Behavioral economics of corruption and its implications”, Brazilian Journal of Political Economy, 41(1), 100-116, DOI: 10.1590/0101-31572021-3104, EDN: JOJLUC.

Povetkina, N.A., Ledneva, Yu.V., & Veremeeva, O.V. (2020), “Women in public finance of Russia and the world”, Woman in Russian Society, (4), 66-81, DOI: 10.21064/WinRS.2020.4.6.

Pond, A. (2018), “Protecting Property: The Politics of Redistribution, Expropriation, and Market Openness”, Economics and Politics, 30 (2), 181-210, DOI: 10.1111/ecpo.12106.

Rose-Ackerman, S., & Palifka, B. (2016), Corruption and Government: Causes, Consequences and Reform, 2nd Edition, Cambridge University Press, DOI:10.1111/gove.12273.

Sharipova, O. O. (2023), “Corruption Is the Bane of National Development NovaInfo”, Ru, (135), 158-159.

Shashkova, A. V., Solovtsov, A. O. (2022), “Factors of Development and Success of Digital Platforms”, The Platform Economy: Designing a Supranational Legal Framework, 19-35.

Smith, V. (2003), “Constructivist and Ecological Rationality in Economics”, American Economic Review, 93 (3), 465-508, DOI: 10.1257/000282803322156954.

Thaler, R. (2016), “Behavioral Economics: Past, Present, and Future”, American Economic Review, 106 (7), 1577-1600, DOI: 10.1257/aer.106.7.1577.

Wakker, P. (2010), Prospect Theory for Risk and Ambiguity, Cambridge University Press, DOI:10.1016/j.joep.2011.03.002.

Winter, H. (2017), Issues in Law and Economics, The University of Chicago Press.

Wright, J. & Ginsburg, D. (2012), “Behavioral Law and Economics: Its Origin, Fatal Flaws and Implications for Liberty”, Northwestern University Law Review, 106, 1033-1088, DOI:10.4324/9781315730882-15.

Zaloznaya, M. (2017), “The Social Psychology of Corruption: Why it does not exist and why it should”, Sociology Compass, 8(2), 187-202, DOI:10.1111/SOC4.12120.