ОСОБЕННОСТИ ФУНКЦИОНИРОВАНИЯ АКЦИОНЕРНЫХ КОМПАНИЙ В РОССИИ СЕГОДНЯ

Aннотация

Автор в данной статье предпринимает попытку выявить особенности функционирования акционерных обществ в России на современном этапе. Опираясь на некоторые информационные ресурсы, автор в начале данной статьи показывает важность, как самих акционерных обществ, так и акционерного капитала, для социально-экономических отношений. Имеют место исторические примеры, например, компания Московия (1555), Чикагская городская железнодорожная компания (1859). Автор исходит из тезиса о том, что менеджер должен знать макроэкономические условия, влияющие на количественные и качественные параметры акционерных обществ в России. Автор исследует ключевые макроэкономические условия на современном этапе: динамика ВВП России, состояние денежной массы, число акционерных обществ, суммарная задолженность акционерных обществ России по обязательствам. Кроме того, автор сопоставляет некоторые макроэкономические параметры России и США. Автор статьи обосновывает вывод о том, что ВВП и денежная масса явно связаны линейной функциональной зависимостью. Исследуемая статистика свидетельствует о проблеме, сущность которой заключается в увеличение суммарной задолженности по обязательствам акционерных обществ в России при одновременном сокращении числа акционерных обществ в России. По мнению автора, подобная ситуация свидетельствует о нарастании деструктивных тенденций в российской экономике, что негативно сказывается на ВВП России. В статье сделан акцент на том, что акционерные общества полезны для макроэкономического развития России.Ключевые слова: акционерные общества, компания Московия (1555), Чикагская городская железнодорожная компания (1859), акционерный капитал, динамика ВВП России, темпы роста денежной массы в России, величина денежной массы, скорость обращения денег, коэффициент корреляции, суммарная задолженность по обязательствам, число акционерных обществ, деструктивная тенденция

К сожалению, текст статьи доступен только на Английском

Theodore Dreiser wrote in 1914: «Like the gas situation, the Chicago street-railway situation was divided into three parts - three companies representing and corresponding with the three different sides or divisions of the city. The Chicago City Railway Company, occupying the South Side and extending as far south as Thirty-ninth Street, had been organized in 1859, and represented in itself a mine of wealth. Already it controlled some seventy miles of track, and was annually being added to on Indiana Avenue, on Wabash Avenue, on State Street, and on Archer Avenue. It owned over one hundred and fifty cars of the oldfashioned, straw-strewn, no-stove type, and over one thousand horses; it employed one hundred and seventy conductors, one hundred and sixty drivers, a hundred stablemen, and blacksmiths, harness-makers, and repairers in interesting numbers. Its snow-plows were busy on the street in winter, its sprinkling-cars in summer. Cowperwood calculated its shares, bonds, rolling-stock, and other physical properties as totaling in the vicinity of over two million dollars» [1]. This fragment reflects the fact that the joint-stock company, as a way of functioning of the business, benefits society and increases employment. We should recognize that among the scientists, there is a strong awareness of the importance of joint-stock companies for the development of economic relations in society. The key point which allows the joint-stock company to operate is a capital. For example, Stiglitz J.E. considered that «Capital is at the heart of capitalism: it is, accordingly, not surprising that we should look to failures in capital markets to account for one of the most important failures of capitalism, the marked fluctuations in output and employment which have characterized capitalism throughout its history» [2, 1].

There is a wonderful historical example of activity of the companies in Russia. For instance, three ships were equipped on a trading expedition to Muscovy in 1553. Two of which were wrecked on the way to Russia. But in spite of this fact, Muscovy Company functioned in 1555 [3, 174]. Muscovy Company had been organized because Ivan IV the Terrible had sent the letter to Queen Mary via the chancellor. «The Company applied for letters of incorporation. These were granted February 6, 1555, from which date the Company`s corporate history begins. The charter of 1555 grants to the Company the exclusive right to trade with any of the Czar`s dominions, establishes the form of government and organization of the Company, and appoints Sebastian Cabot to be Governor of the Company during the remainder of his life» [4, 16]. Muscovy Company has exported honey, furs, iron, copper, steel, timber, rye, wheat, linen successfully. This is a positive historical example of international cooperation.

The certain conditions affect the quantitative and qualitative parameters of joint stock companies in Russia at the present stage. A manager must understand these macroeconomic conditions clearly. The first condition is the state of the money supply (diagram 1).

Diagram1. Money supply M2 in Russian economy [5]

Money supply in Russia increased during the period: to 4.4712 trillion rubles for the period 2010-2011, or 22.34%; to 2.9223 trillion rubles for the period 2011-2012, or 11.94%; to 7.3935 trillion rubles for the period 2010-2012, or 36.95%. Money supply increases during the study period, as confirmed by both absolute and relative data.

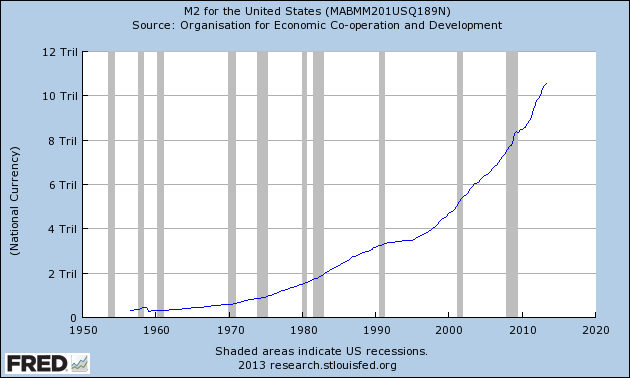

There is a question – monetary growth in Russia is a positive or negative phenomenon in macroeconomics of Russia? First of all we should pay attention to the corresponding situation in the U.S., because Russia is a participant in the world economic system and we can not examine economic conditions and processes in Russia in isolation from the international economic relations. Money supply of the United States for the period 1950-2013 is as follows, according to Organization for Economic Co-operation and Development. We appeal to the content of diagram 2.

Diagram 2. The Money supply of the United States for the period 1950-2013 [6]

Then we appeal to equation of exchange [7] by Irving Fisher for the answer to this question. According to the theory of Mr. Fisher, in a macroeconomic aspect should be the equilibrium between the money side of the equation of exchange, which is expressed by multiplying the amount of money on the velocity of money and the commodity side of the equation of exchange, which is expressed by multiplying the level of prices (goods, services, results of intellectual activity) by the volume national product for the period. A similar idea was presented earlier. «The total quantity of money functioning during a given period as the circulating medium, is determined, on the one hand, by the sum of the prices of the circulating commodities, and on the other hand, by the rapidity with which the antithetical phases of the metamorphoses follow one another. On this rapidity depends what proportion of the sum of the prices can, on the average, be realised by each single coin. But the sum of the prices of the circulating commodities depends on the quantity, as well as on the prices, of the commodities. These three factors, however, state of prices, quantity of circulating commodities, and velocity of money-currency, are all variable. Hence, the sum of the prices to be realised, and consequently the quantity of the circulating medium depending on that sum, will vary with the numerous variations of these three factors in combination. Of these variations we shall consider those alone that have been the most important in the history of prices» [8, 80].

Adam Smith made first steps to scrutinize the issue in 1776: «The gross revenue of all the inhabitants of a great country comprehends the whole annual produce of their land and labour; the neat revenue, what remains free to them, after deducting the expense of maintaining first, their fixed, and, secondly, their circulating capital, or what, without encroaching upon their capital, they can place in their stock reserved for immediate consumption, or spend upon their subsistence, conveniencies, and amusements. Their real wealth, too, is in proportion, not to their gross, but to their neat revenue» [9, 231]. Adam Smith explained: «Money, therefore, the great wheel of circulation, the great instrument of commerce, like all other instruments of trade, though it makes a part, and a very valuable part, of the capital, makes no part of the revenue of the society to which it belongs; and though the metal pieces of which it is composed, in the course of their annual circulation, distribute to every man the revenue which properly belongs to him, they make themselves no part of that revenue…It is sufficiently obvious, and it has partly, too, been explained already, in what manner every saving in the expense of supporting the fixed capital is an improvement of the neat revenue of the society. The whole capital of the undertaker of every work is necessarily divided between his fixed and his circulating capital. While his whole capital remains the same, the smaller the one part, the greater must necessarily be the other. It is the circulating capital which furnishes the materials and wages of labour, and puts industry into motion. Every saving, therefore, in the expense of maintaining the fixed capital, which does not diminish the productive powers of labour, must increase the fund which puts industry into motion, and consequently the annual produce of land and labour, the real revenue of every society» [10, 235-236]. Adam Smith's book «The Wealth of Nations» was the basis for further researches. For the context of this article, one of the conclusions to be drawn from the quoted passage is that the joint-stock companies are important for increasing the proportion of the capitalization, because the joint-stock companies are reliable and effective mechanism which is helpful to society.

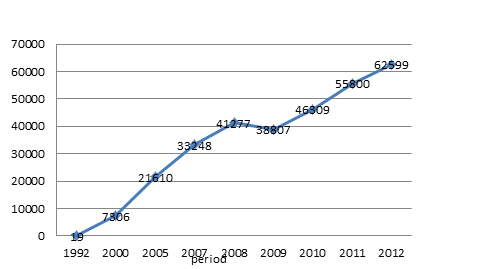

Gross domestic product is one of the key conditions affecting the functioning of the joint-stock companies. Therefore we should consider the dynamics of Russian GDP (diagram 3).

Diagram 3. The dynamics of Russian GDP, total, bln. roubles (before 2000 – trln. roubles) [11]

The increase in the money supply with the growth of Russia's GDP is logical. For the period the correlation coefficient between GDP and the money supply is 0.990643, according to the calculations. The degree of closeness of the connection between the studied parameters is high. Thus GDP and money supply are clearly related linear functional relationship. This phenomenon corresponds to the world practice. According to data of U.S. Department of Commerce: Bureau of Economic Analysis, the dynamics of U.S. GDP for the period 1940-2013 is as follows (diagram 4).

Diagram 4. The dynamics of U.S. GDP for the period 1940-2013 [12]

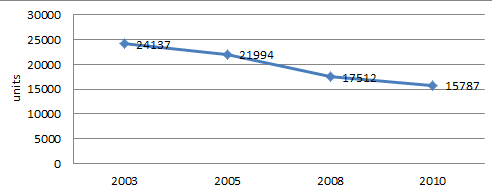

We think that it is appropriate to consider number of joint stock companies in Russia for the period 2003-2013, but there is the complexity of the case (diagram 5).

Diagram 5. The number of joint stock companies in Russia for the period 2003-2010 [13]

Search for information on the number of joint-stock companies to 2014 is problematic. Searching for information in other original sources has no results. For example, we tried to investigate the matter at the Unified State Register of Legal Entities on the site of Federal tax service of Russia (http://www.nalog.ru/). This information is not available. We have tried to study this issue on the basis of scientific articles by the other authors on the site of Scientific Electronic Library (http://elibrary.ru/), in the free-access journals, but in this case the information is not available. Scarcity of information makes it difficult to research, making them irrelevant. Outdated information makes it difficult for understanding.

Our opponents may argue – quantitative indicators are not the key. We agree with the opponents and therefore turn to the consideration of such qualitative indicators of joint stock companies in Russia, as the total debt obligations (diagram 6). There is information in the free access for the period 2000-2012.

Diagram 6. The total debt liabilities of joint stock companies in Russia for the period 2000-2012 (million rubles, at the end of the year) [14]

The increase in total debt for the obligations of joint stock companies in Russia amounted to 5543151 million rubles. It is difficult to estimate this figure because, from a practical point of view, it is the norm for the joint stock company to have the debt obligations. We understand that the value of debt obligations of the joint stock company should be commensurate with the value of the share capital, needs of the business and the current macroeconomic conditions. But the fact that there is an increase in the total debt obligations of the joint stock companies in Russia, while reducing the number of joint stock companies in Russia, indicates the growing destructive tendencies in this segment of the economy.

Decrease of the number of joint stock companies in Russia while increasing the money supply (M2) in Russia (Diagram 1) forms the other macroeconomic problem. Obviously, the joint-stock companies represent an effective mechanism capable of handling the increasing money supply. Otherwise, it may be imaginary GDP. We think that the imaginary GDP - this is the situation in the economy, in which there are not enough real goods, services, results of intellectual activity. However, the government increases the money supply in an attempt to fulfill the social obligations to the citizens. On the basis of Irving Fisher's equation of exchange, there is a disproportion between the commodity and money sides of the equation. Such a situation leads to an inflationary spiral.

The attempt is made in Russia to implement reforms in order to transition to market economic relations. Joint stock companies are the major element for the formation and development of market economy in Russia, both in institutional and a functional point of view.

Список литературы